Are we now comfortable with the uncomfortable?

Notching its eighth consecutive quarterly advance, the S&P 500 rose approximately 4.4% in the past three months. What’s more remarkable is the resiliency of the market in the face of events that would historically cause periods of panic, leading to increased volatility as equity markets sell off and investors flock to the safety of bonds. In years past, life altering events typically force the market into disarray; however, despite recent events such as the standoff with North Korea, the multitude of natural disasters, the Charlottesville unrest, Catalan turmoil in Spain and the Las Vegas shooting, the equity markets keep shrugging off every occurrence and continue chugging along. The lack of inflation, steady economic growth, accommodative monetary policy, strong labor market and very strong earnings growth have created a robust tailwind for equities, creating a sense of investor complacency with what would traditionally be viewed as an uncomfortable turn of events.

Although Small Caps have made up some ground in the third quarter, US Large Caps have still held the edge for the year, with the S&P 500 and Russell 2000 posting returns of 14.24% and 10.94%, respectively. Technology continues to drive US the market higher, as evidenced by the 20.67% NASDAQ year-to-date return. While domestic stocks have posted strong returns, they have been outdone by foreign equity markets, as the MSCI EAFE index, representing developed international equities, was up 20.47%, and the MSCI Emerging Markets index posted a return of 28.14%. Bonds continued their yo-yo year, in which the yield curve continued to flatten, and interest rates fell to 2.04% on the 10-Year Treasury, before bouncing up above 2.3% in the final weeks. These movements were a net positive for the returns in the bond market, as the Barclay’s US Aggregate Bond Index is returning 3.14% for the year.

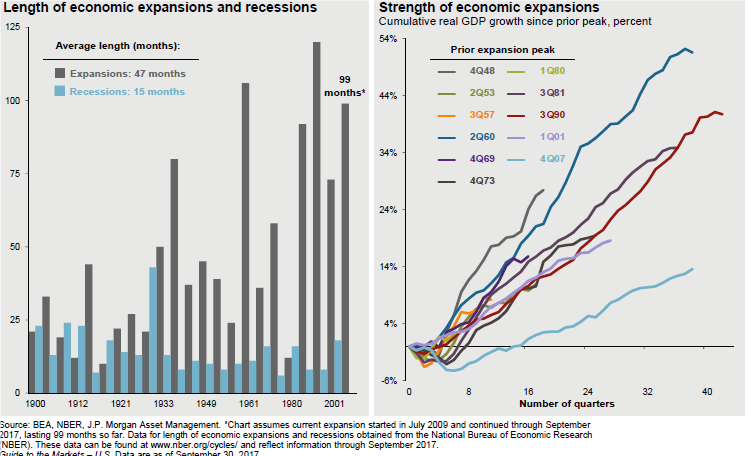

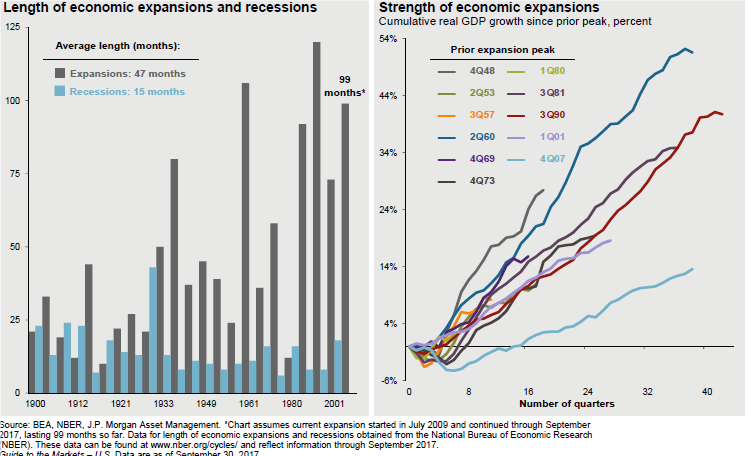

Long economic cycle might get longer

While we are going on our ninth year of economic expansion, many have started to speculate that based upon the duration of the expansion alone, the end must be in sight. Recessions are generally caused by one of three incidents: growing inflation to the point central banks believe it must be contained, a monetary policy error of some kind and/or an exogenous event. Wage growth tends to be a strong barometer, as when wage growth typically reaches the 4% level, both a recession and inverted yield curve are close behind. Today’s 2.5% wage growth and sub-2% QUARTERLY CLIENT UPDATE inflation suggests we have a long way to go. Consumers continue to be the economy’s workhorse, increasing their spending at a 2.7% clip, while drawing down savings. The upcoming holiday season should provide valuable insight into consumer demand. The labor market continues to tighten, as we move into full employment levels, with a 4.4% unemployment rate, and upward trending, albeit slow, wage growth. Manufacturing continues to show steady improvement, as new orders have been increasing alongside declining inventories. The bevy of natural disasters experienced in recent months truly devastated many communities; it’s our belief that they will disrupt and negatively impact economic activity in the near term, as already witnessed by the disturbances in unemployment claims and housing. However, history would suggest that storms are unlikely to materially impact the course of the economy over the medium term, and given the current momentum, we anticipate our moderate growth continue.

The tale of the Fed and the “mystery” of the missing inflation

In the world of central bank transparency which we now live, the Federal Open Market Committee (FOMC) delivered as previously signaled, and in their September meeting they decided against a current rate increase and officially announced the unwinding of their $4.5 trillion balance sheet, starting in October. What the market did find surprising was the Fed’s apparent determination to raise rates once more in 2017, and three times in 2018. Speculators saw the odds of the Fed raising rates in December jump from approximately 20% to over 70%.

The Fed has been cautious in their approach to balance sheet reductions in efforts to avoid another instance such as the “Taper Tantrum” we experienced in 2013. As we outlined earlier in the year, they will institute a system of monthly caps, limiting the amount of Treasuries and mortgage bonds that can roll off the balance sheet in any given month. Currently, as assets on the balance sheet mature, the proceeds are reinvested. Once the Fed begins to implement their strategy, rather than investing all of the maturing proceeds, they will allow a capped dollar amount to “roll off” and not be invested. Treasuries’ initial cap will be $6 billion per month, set to increase by $6 billion each quarter until reaching a maximum of $30 billion a month. US Agency and mortgage bonds will have an initial cap of $4 billion, set to increase by $4 billion per quarter until reaching a maximum of $20 billion a month. Any maturities in excess of those caps will be reinvested. The total balance sheet run-off in the first year could reach as high as approximately $300 billion. While no official target balance sheet size has been released, several Fed governors have suggested a range of $2 to $2.5 trillion. As a point of reference, in 2008, the balance sheet was approximately $800 billion.

Given their plans to raise rates four times between now and the end of 2018, along with the autopilot program they’ve put in place for balance sheet reduction, it would appear that the Fed is starting to move away from their data-dependency mantra of years past. Fed Chair Janet Yellen’s acknowledgment that the fall in inflation this year is a bit of a “mystery,” and further suggestion that the central bank stays the course and increases rates, surprised the markets and goes to demonstrate that the Fed is bent on normalizing, regardless of inflation figures. Apparently, the Fed is perceiving the falling inflation as transitory, but given the downward trend over the last year, it’s getting harder to classify falling inflation as such. Rising inflation tends to push bond yields higher via expectations, but inflation has been trending lower, which is a primary reason rates are lower on the 10-Year Treasury today than they were at the start of the year. We expect that it will take a more substantial uptick in wage growth to truly drive inflation, and will be watching carefully to see the impact of the Fed’s game plan for 2018.

Can Washington remove their dysfunction in order to function?

The market and the Fed have essentially determined that any fiscal impact as a result of policy initiatives will be pushed into 2018. After several attempts and failures, it appears the GOP has finally accepted that the Affordable Care Act will not be overturned in 2017, if at all, as they have quickly pivoted their attention to tax reform. The initial attempt at tax reform was proposed at the end of the quarter, with some rather lofty suggestions which could alter our tax landscape significantly. The most impactful adjustment to the tax reform framework would be the reduction in the Corporate Tax Rate to 20% and the equalization of pass through entities – effectively lowering the tax rate on small businesses. Significant change would also be in order for individuals, with the doubling of the standard deduction in an attempt to provide tax relief to the middle class, a move to three individual tax brackets – lowering the top income tax rate to 35%, the elimination of the state and local tax (SALT) deduction and the removal of estate taxes and step-up in basis provisions. The proposal also has a somewhat surprising proposal for the Rothification of retirement savings – forcing people out of traditional retirement plans and toward Roth plans by removing the ability to deduct or save for retirement on a pretax basis. While seeking approval for the proposed tax reform framework will be faced with difficulties, it’s only one step in the two step process. Step one involves the passage of a budget resolution, which is absolutely critical for tax reform, since it creates the reconciliation protection for the Senate to pass tax legislation with 51 votes. While we ultimately believe a budget resolution will be reached in the fourth quarter, there are many reasons the budget resolution could be met with opposition. For instance, House conservatives will want more spending cuts, which would make passing through the Senate unlikely. House conservatives might want more details on tax reform prior to opening up the reconciliation window. Moderate House members from high-tax states could be up in arms over the possibility of losing state and local tax deductions.

Clearly tax reform has a long road ahead to push any of the reform framework through, and that’s not even taking into consideration that the Democrats possess significant leverage in negotiations as the debt ceiling still lingers. President Donald Trump made a surprise move and sided with the Democrats to provide aide to hurricane victims, and in doing so kicked the proverbial debt ceiling can down the road until December. While many applauded the bipartisan move to lift the debt ceiling, it will be difficult for the Republicans to push a budget through that expands the deficit by $1.5 trillion, and subsequently convince the Democrats to lift the debt ceiling to fund these cuts.

Divergence making for good opportunities outside of America

On the back of extremely accommodative monetary policy, the United States’ markets rebounded strongly as they lead the way out of the Great Recession. Monetary policy served as steroids to the equity markets as they continued to push higher. Central banks around the world eventually followed suit and started to implement their own forms of Quantitative Easing (QE), or the buying of bonds to limit the money supply and keep long term interest rates compressed. Unlike the US, foreign markets remained directionless for several years; however, as the world’s economies have recovered, we are enjoying a coordinated global expansion, mixed with diverging monetary policies. As previously discussed, the United States has started down their path to normalcy, while the rest of the world continues to practice accommodation and have a pro-growth mindset. As the major political risks have subsided in Europe, the region has now turned attention to the economy, where growth is positive, sentiment is strong and unemployment continues to fall. Even though the market continues to disregard what’s transpiring in Spain and the Catalan referendum, we are closely monitoring as a potential short-term risk and otherwise look to the 2018 elections in Italy as the next major political headwind.

The outlook for foreign stocks remains favorable with strong corporate profit growth, accommodative credit conditions and low inflation. Foreign equities continue to perform well, and have been enhanced in 2017 by weakness in the dollar. Despite the recent outperformance, we still favor the relative valuations of international equity relative to the US, particularly in continental Europe and Japan, where monetary policy continues to accommodate over the United Kingdom as they continue to deal with fallout from Brexit.

We remain optimistic and view the risk and opportunities in emerging markets as fairly balanced as we finish out 2017. Of particular note are China’s maturing economy and the emerging market middle class. While all signs point to China achieving their 2017 growth target, we believe China may experience a slowdown in 2018, as authorities engage in tightening credit conditions in order to reduce financial system risk and reliance on credit expansion. We will re-evaluate our positions in the intermediate term future.

Conclusion

The first three quarters have been incredibly smooth for investors, and the fourth quarter has historically been strong for equities. While all economic signs point toward continued improvement, volatility often resurfaces at unforeseen times. Though we remain positive in our outlook, we would urge continued prudence by investors in maintaining proper diversification, as well as conviction in a long-term approach, should an unexpected period of rocky market conditions surface. We will continue to closely monitor new data as it becomes available. In addition, we will make adjustments if needed as we wind down the year. As always, please feel free to contact your advisor with any questions, or to set up your next review.

We are here to assist you with your planning and investing, so you can focus on living.

If you don’t currently have a plan, we’ll discuss options. If you already have a plan we’ll discuss how it is set-up and how we can improve it!

You can call us directly or visit our office too!

Hagan Newkirk | Plan, Invest, Live

Central Arkansas Corporate Office

6235 Ranch Drive

Little Rock, AR 72223

Phone: (501) 823-4637

Email: info@hagan-newkirk.com