How to Increase Employee Participation in Your Company’s Retirement Plan

All employers want to increase participation in their retirement plans, right?

We may all want it, but do our actions drive an increase in participation? Maybe not…

First thing that any plan sponsor has to do, before they can increase participation, is to define what “increase participation” is for their plan. Maybe, “increase participation” means that you want the people that are already contributing to contribute more. Or maybe, you want more of your employees contributing to the plan. Either way make sure to define what it means to increase participation for you and your plan.

Many plan sponsors assume fixing one part of their plan will automatically increase participation. So, they lower fees or allow for Roth contributions or etc., but still not much growth within the plan. Maybe they improve the company match, but no change in behavior. The problem is that they might not be looking at the plan holistically or how those changes synchronize with education to the participants. They fix one aspect to the plan hoping that betters participation amongst all employees.

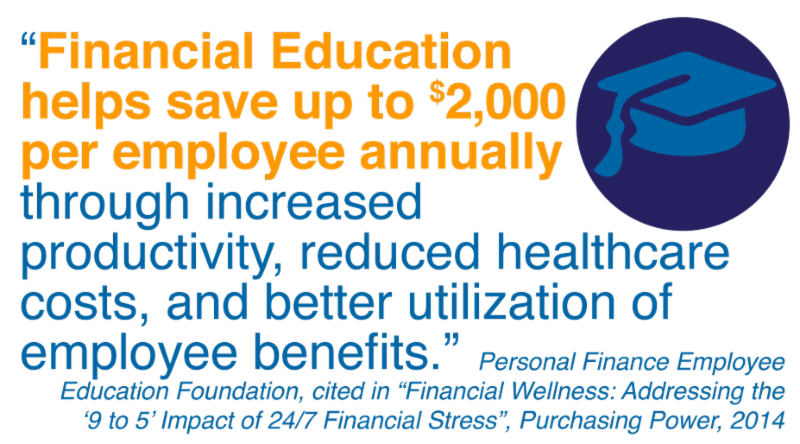

Sponsoring a retirement plans is much more complex these days. Increasing the company match and lowering the fees are great efforts to do and should be done when possible, but if your employees are not EDUCATED on how to use your plan effectively or made familiar with the changes you are implementing, those things will not help your plan grow consistently, thus benefit your employees. It is critical that you have support structures in place that help educate all of your employees, not just those in the “C suites” or highly compensated, on how to manage money and save efficiently for retirement. That education support becomes the foundation for effective and sustained increased participation.

Why does this matter?

It matters because it’s costing you…

A primary goal of any retirement plan is to obtain and retain quality employees. Your retirement plan should be attractive to potential employees while also staying current with services, options and low fee structures, so that, you can retain those employees. That is why the Department of Labor (DOL) recommends that you benchmark your plan every 3 years. Also, when employees are not at a healthy place financially, they are distracted at work. This costs your company money because they do not perform their job effectively, reducing productivity.

Another goal for your retirement plan is to help your older employees achieve a dignified retirement. Accomplishing this is not only the right thing to do for your employees, but it is also good for business.

You have the responsibility, as a leader in your company, to act with the best interest of your employees. It can be frustrating when you feel like you have all the right pieces in place for your retirement plan, but still have a low participation rate. We believe that if you have a process in place that helps to educate your employees on the importance of retirement savings and how to utilize the benefits offered by their employer, plan participation will increase.

Please, don’t hesitate to reach out to us if you have any questions about how to customize and implement a process for you and your plan.

Want to know how Hagan Newkirk increases participation for their clients?

Follow us on Facebook | LinkedIn | YouTube | Google+

If you don’t currently have a plan, we’ll discuss options. If you already have a plan we’ll discuss how it is set-up and how we can improve it!

You can call us directly or visit our office too!

Hagan Newkirk | Plan, Invest, Live

Central Arkansas Corporate Office

6235 Ranch Drive

Little Rock, AR 72223

Phone: (501) 823-4637

Email: info@hagan-newkirk.com